As on As one of the leading market makers in Germany, we manage more than 800,000 securities at numerous trading centres. Benefit from our many years of broad experience in trading.

At gettex

No exchange fees, reliable pricing and fast order execution - this is how trading and the stock exchange work today, this is how gettex works. The trading centre of the Munich Stock Exchange offers you the highest quoting and execution quality, embedded in an exchange-based set of rules - powered by Baader Trading.

Direct trading

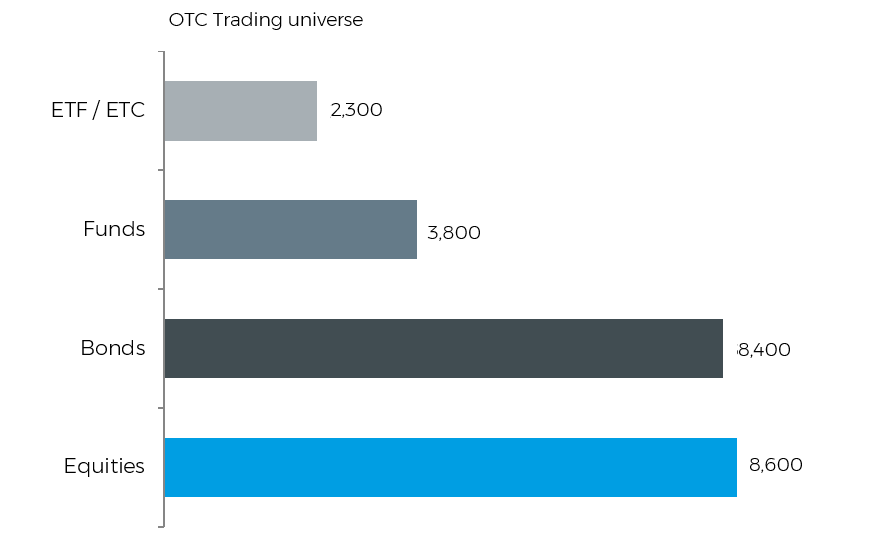

We quote more than 23,000 securities within the asset classes equities, bonds, ETF/ETC and funds. In doing so, we pay particular attention to narrow and market-driven spreads as well as sufficient liquidity at all times.

Swiss equities

Due to an agreement between Switzerland and the EU, it is not possible to buy or sell Swiss shares on German stock exchanges ("stock exchange equivalence"). This restriction does not apply to over-the-counter trading, so you can use our direct trading offer to gain efficient access to Swiss shares.

Quick & cost-effective

Due to a high degree of automation, we are able to execute securities orders in a matter of seconds. Baader Bank does not charge any fees or transaction charges for the execution of your securities order - whether on gettex or in direct trading.

Expanded trading hours

Baader Bank is expanding its trading offering and extending the trading hours in over-the-counter direct trading (OTC) and together with the Bavarian Stock Exchange on gettex. The new, extended trading hours apply from 07.30 to 23.00.